Of all the organizations you need to notify, HMRC is the one you really don't want to get wrong. While a delayed library card update is annoying, a delay with HMRC can hit your wallet directly—holding up tax rebates, complicating self-assessment returns, or causing issues with your state pension contributions.

Government systems are vast and often slow to talk to one another. If your employer is paying "Sarah Smith" but HMRC thinks you are "Sarah Jones," their automated systems may flag a discrepancy.

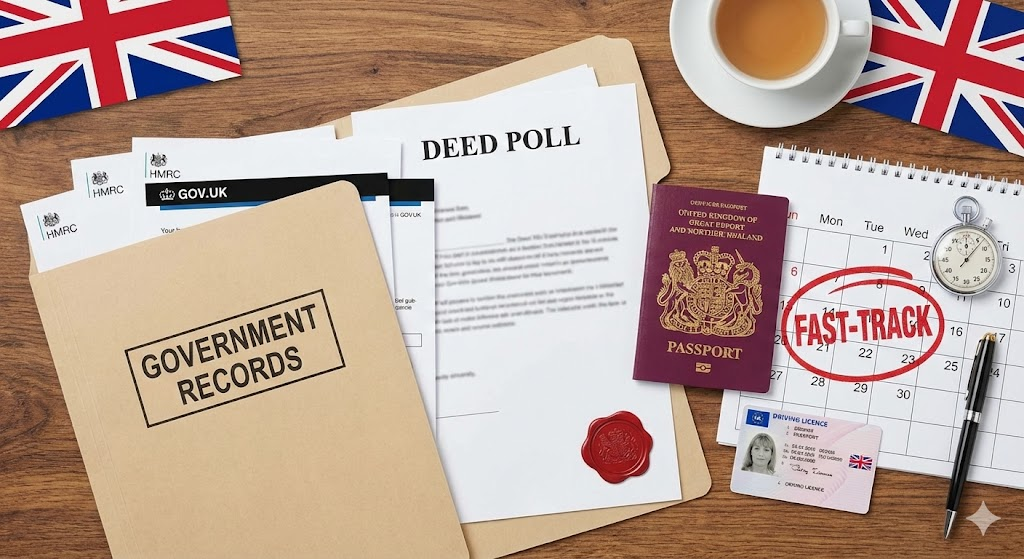

To ensure your tax affairs remain smooth during your transition, follow these steps to bypass the bureaucratic delays.

1. Use the Digital "Fast Lane" (Personal Tax Account)

In the past, you had to write a formal letter to your local tax office and wait weeks for a reply. Today, the absolute fastest way to update HMRC is via the Personal Tax Account on GOV.UK.

If you don't have one, set it up immediately. It links to your National Insurance number. Once logged in:

- Go to the "Profile" or "Personal Details" section.

- Update your name.

- In most cases, this updates their main database within 48 hours.

Note: This usually handles your Income Tax and National Insurance records. However, it does NOT automatically update benefits (see below).

2. Synchronize with Your Employer

This is the most common cause of friction. You must ensure that the name your employer uses for payroll matches the name HMRC holds.

The Strategy: Do not tell your employer on Monday and HMRC on Friday. Try to do them simultaneously.

If your employer sends their monthly "Real Time Information" (RTI) report to HMRC using your new name, but HMRC hasn't updated their side yet, it creates a "mismatch error." While the system usually figures it out via your National Insurance number, it can cause delays in your tax code adjustments.

3. Don't Forget the DWP (Benefits are Separate)

A huge misconception is that "The Government" is one big computer. It is not. Updating HMRC does not automatically update the Department for Work and Pensions (DWP).

If you receive any of the following, you must contact the specific office handling your claim separately:

- Universal Credit: Use your online journal to report a change of circumstances.

- Child Benefit: This is handled by a specific HMRC department but often requires a separate notification if not updated via the Personal Tax Account.

- State Pension: Contact the Pension Service.

4. Timing Your Self-Assessment

If you are self-employed, be very careful about when you change your name.

The Trap: Changing your name legally a few days before the January 31st tax return deadline.

If you try to file a return in a new name that HMRC hasn't processed yet, or if you are waiting for a new Government Gateway ID, you could miss the deadline and incur a £100 fine.

The Fix: Either change your name well before tax season (November/December) or wait until after you have filed your return in February.

5. Your National Insurance Number Stays the Same

We often get asked: "Do I get a new NI number?"

The answer is No. Your National Insurance number is your life-long identifier. It is the "golden thread" that ties your old identity to your new one. Never lose this number. When writing to any government department about your name change, always write your NI number at the top of the letter. It is the only way they can locate your file if the names don't match.

Conclusion

Avoiding delays with the government is about order and method. Go digital where possible, synchronize your employer update, and treat benefits agencies as separate entities.

The foundation of all these updates is a valid Deed Poll. Without it, HMRC will not touch your records.