Changing your name is an exciting fresh start, but for your finances, it can be a moment of confusion. If you don't connect your old name to your new one, you risk becoming a "financial ghost"—someone with no credit history, no address history, and no way to get a mortgage or phone contract.

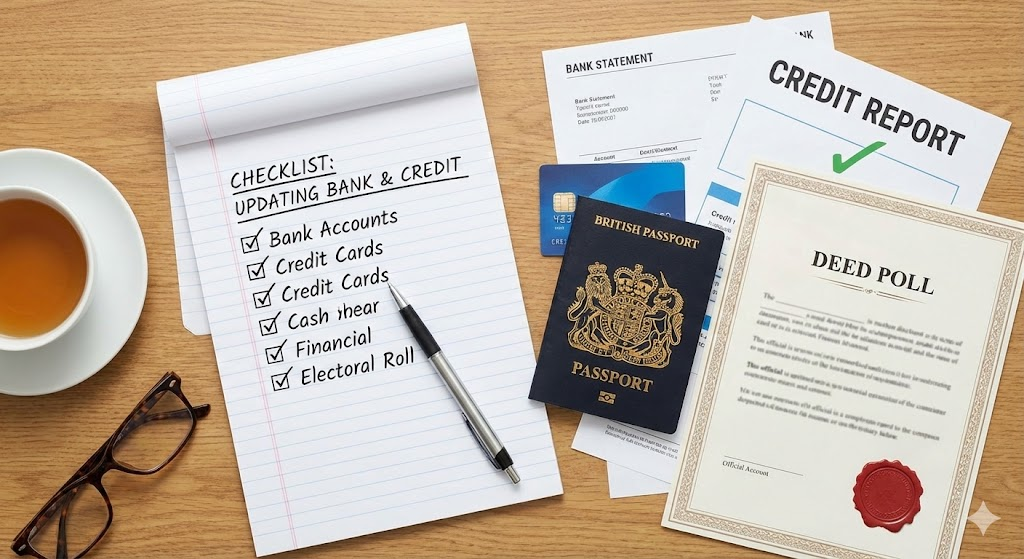

To keep your financial health in top shape, you need to proactively update your records. It isn't automatic; the Deed Poll is the tool, but you have to do the work. Here is your ultimate checklist for updating your financial life.

1. The High Street Bank (The Hub)

Your main current account is the most important domino. Once you update this, your bank will start reporting your new name to the credit reference agencies, which helps create the vital link between your past and future financial self.

How to do it

While digital banks like Monzo or Starling may allow you to send a photo of your deed poll via in-app chat, most traditional high-street banks (Barclays, Lloyds, Santander, etc.) still require a branch visit.

What to bring:

- Your original Deed Poll (not a photocopy).

- Your existing debit card.

- Photo ID (It is okay if your passport/driving licence is still in your old name, as the deed poll bridges the gap).

2. The Electoral Roll (Crucial)

Credit Reference Agencies (Experian, Equifax, TransUnion) use the electoral roll to verify your address and identity. If you are registered to vote under your old name but try to apply for credit in your new name, the computer will say "no."

Action: Contact your local council or visit the government website to update your voter registration immediately.

3. Credit Cards and Loans

If you have credit cards with providers other than your main bank (e.g., an Amex or a store card), you must contact them individually. Do not assume they will know just because you updated your main direct debit.

Warning: If you forget to update a store card and miss a payment because the statement went to the wrong name/address, it can damage your credit score.

4. Credit Reference Agencies

Usually, updating your bank and electoral roll is enough. The agencies will eventually catch up and create an "alias" link on your file (e.g., "Sarah Jones is also known as Sarah Smith").

However, we recommend checking your credit report 6–8 weeks after your name change. If your old history hasn't merged with your new name, you can file a Notice of Correction. This is a short note you ask the agency to add to your file, explaining: "I changed my name from X to Y on [Date] via Deed Poll. Please link these records."

The Master Checklist

Use this list to tick off every institution you need to contact:

Priority

- Main Bank Account: Request new debit cards and chequebooks.

- Electoral Roll: Update via local council.

- Mortgage Provider / Landlord: Essential for address proof.

- Employer / Payroll: Ensure your payslips match your bank account name.

Secondary

- Credit Cards: Update all secondary cards.

- Loans: Student loans, car finance, personal loans.

- Insurance: Car, home, pet, and life insurance (very important for valid claims).

- Pension Providers: Private and workplace pensions.

- Investments: ISAs, trading apps, Premium Bonds (NS&I).

Conclusion

It sounds like a lot of admin, but you don't have to do it all in one day. Start with your main bank and the electoral roll—these are the anchors of your financial identity. Once those are fixed, the rest follows easily.

To get started, make sure you have enough original copies of your deed poll to show multiple banks or lenders if needed.